It's every letting agent's nightmare. A tenant moves out, there's a dispute over cleaning costs, and you go to make a deduction from the deposit only to discover... it was never protected. Or the protection lapsed. Or you can't find the certificate.

Suddenly you're facing a potential claim of up to three times the deposit amount, plus the deposit itself. For a typical deposit of six weeks' rent at £1,200 per month, that's nearly £10,000 at stake - not to mention the reputational damage.

The deposit protection regulations have been in place since 2007, but compliance remains one of the biggest headaches for letting agents. Not because agents don't care, but because tracking dozens or hundreds of deposits across different protection schemes, with varying tenancy dates and renewal requirements, is genuinely difficult.

We've built deposit protection tracking into LetAdmin that makes compliance simple and visible.

The Challenge of Deposit Tracking

If you're managing many properties, you might have deposits with TDS, DPS, and MyDeposits. Some tenancies have had multiple renewals, each potentially requiring re-protection or certificate updates. Some tenants paid zero deposit (increasingly common with deposit replacement schemes). Some are company lets where deposit protection rules don't apply.

Keeping track of all this in spreadsheets or in your head is asking for trouble. And most property software treats deposit protection as an afterthought - a field to fill in rather than a compliance system to manage.

Visual Warnings for Unprotected Deposits

The first thing you'll notice in LetAdmin is that tenancies with missing deposit protection stand out. In your tenancy list, any tenancy that should have a protected deposit but doesn't will show a pulsing warning indicator and a clear "Missing Deposit Registration" badge.

This isn't a report you have to remember to run. It's visible every time you look at your tenancies. The problems don't hide - they announce themselves.

The system understands context, too. A tenancy with a zero deposit won't trigger a warning, because there's nothing to protect. A company let won't trigger a warning, because the deposit protection regulations apply to Assured Shorthold Tenancies with individual tenants, not commercial arrangements.

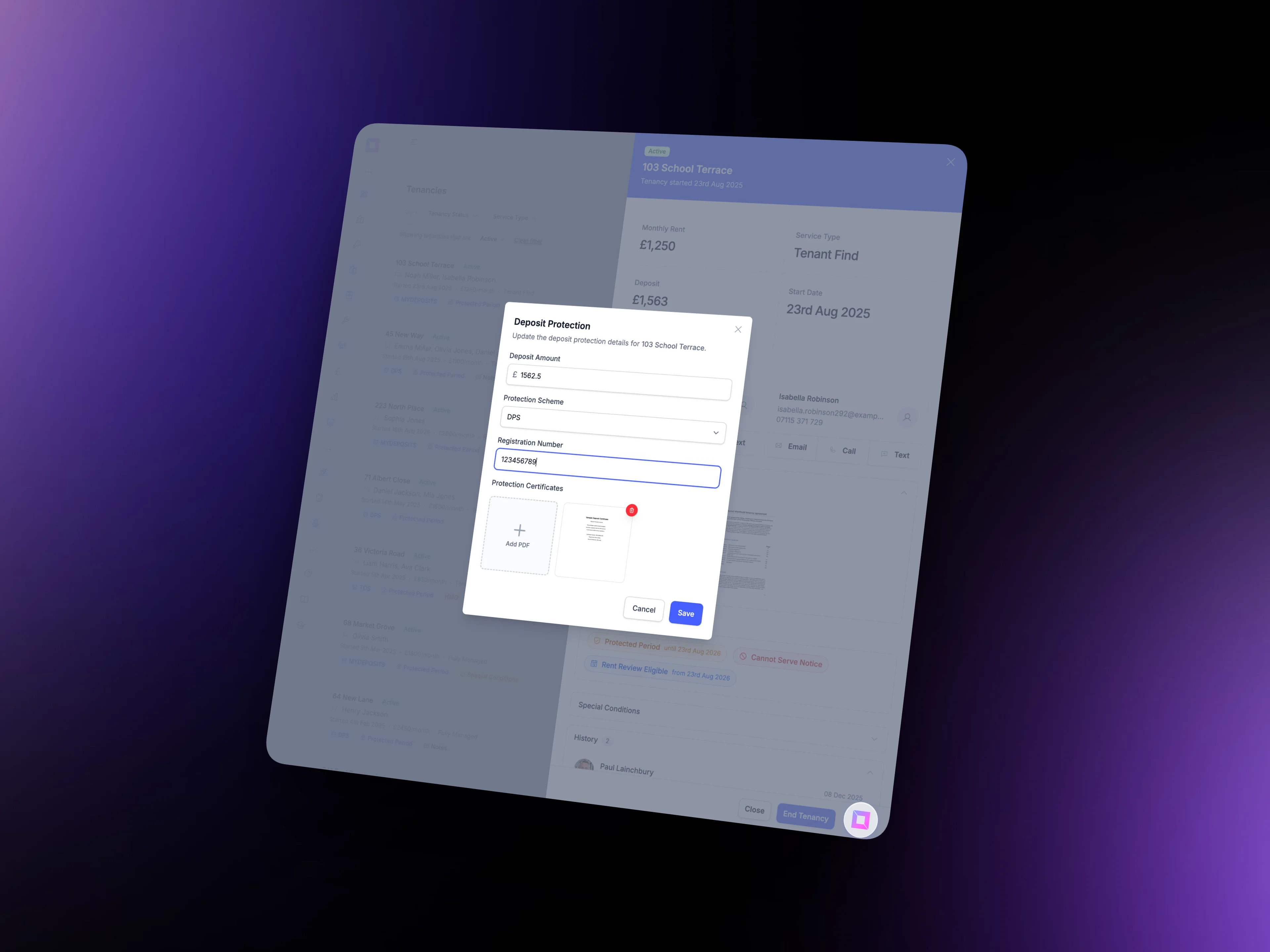

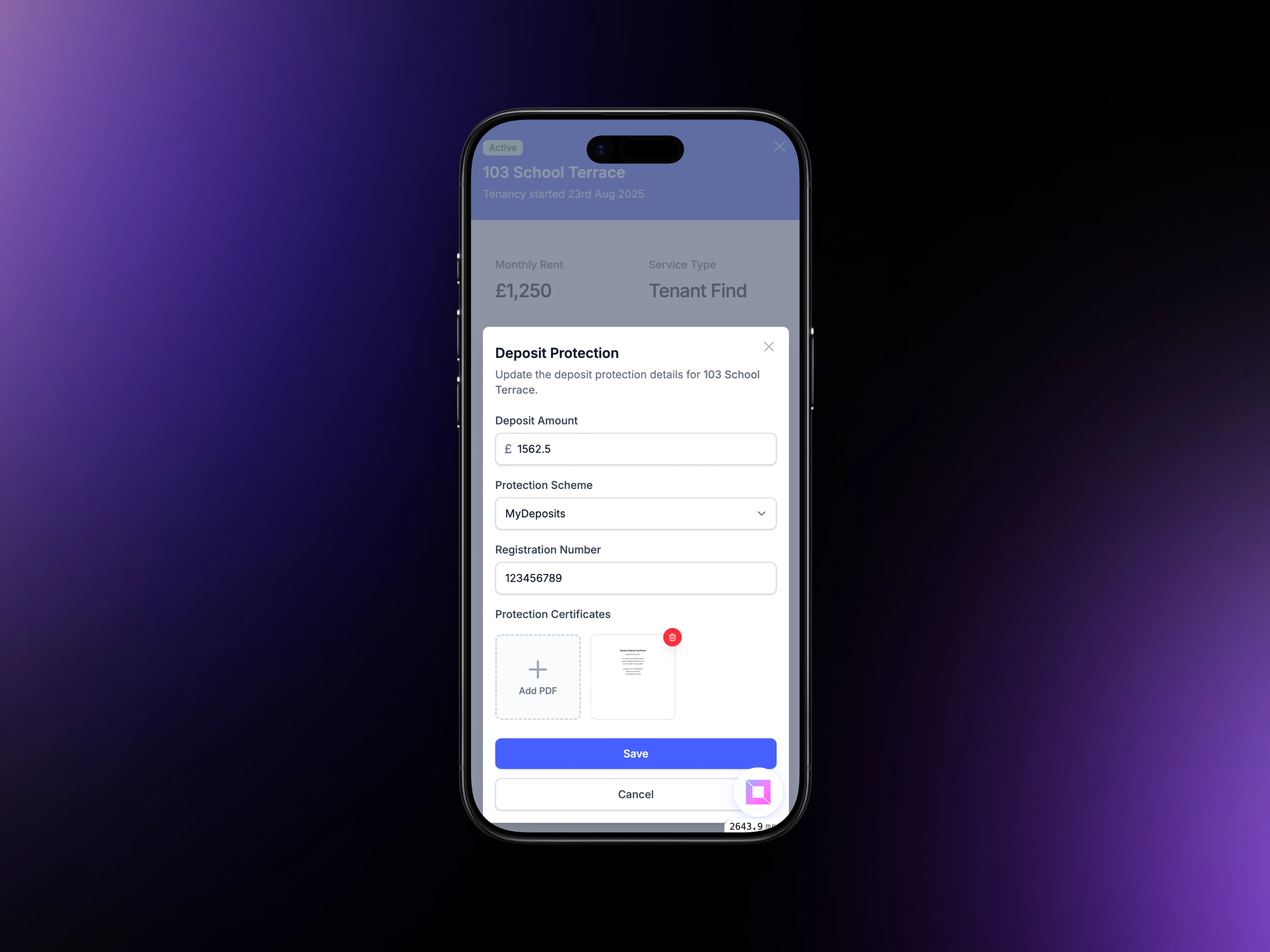

Complete Deposit Information in One Place

For each tenancy, you can record:

The deposit amount - Whether it's the traditional five or six weeks' rent, or a reduced deposit, or zero.

The protection scheme - Choose from TDS, DPS, or MyDeposits. Your agency's preferred schemes are pre-configured so you don't have to type them each time.

The registration number - The unique reference from the protection scheme, which you'll need for any end-of-tenancy disputes.

The protection date - When the deposit was registered, so you can track compliance with the 30-day deadline.

The certificate - Upload the protection certificate directly. We'll generate a thumbnail preview so you can see at a glance that it's the right document.

All of this is visible in the tenancy slideover without navigating to a separate screen.

Multiple Certificates for Complex Situations

Tenancies aren't always straightforward. A tenant might start with one deposit amount, then vary the tenancy and adjust the deposit. Or you might have re-protected a deposit after a tenancy renewal (though note that continuous periodic tenancies generally don't require re-protection).

LetAdmin supports multiple deposit protection certificates per tenancy. Upload as many as you need, and they're all stored together with the tenancy record. Drag and drop makes uploading quick, and thumbnail previews help you identify each document.

Smart Handling for Zero Deposits

Deposit replacement products have become increasingly popular. Tenants pay a non-refundable fee instead of a traditional deposit, and the replacement scheme covers the landlord for any end-of-tenancy deductions.

When a tenancy has a zero deposit recorded, LetAdmin automatically:

- Hides the deposit protection fields (since there's nothing to protect)

- Removes any "missing registration" warnings

- Shows "No deposit" clearly in the tenancy summary

This prevents false compliance warnings and keeps your tenancy list clean and accurate.

Company Lets Handled Correctly

Company lets - where the tenant is a limited company rather than an individual - have different rules. The deposit protection regulations and the Renters' Rights Act apply to Assured Shorthold Tenancies, which by definition have individual tenants.

When a tenancy has an organisation as the tenant, LetAdmin automatically:

- Shows "Registration not required (company let)" instead of compliance warnings

- Hides the RRA compliance section (since it doesn't apply)

- Treats the tenancy differently in compliance reports

This context-awareness means your compliance view reflects reality, not a one-size-fits-all rulebook.

Batch Import from Deposit Schemes

If you're moving to LetAdmin from another system, or if you've been tracking deposits elsewhere, you don't have to re-enter everything manually. We've built import tools that can pull deposit data and certificates from the major protection schemes.

For each import, we match deposits to tenancies using the registration number, update the records, and attach the certificates. What might take hours of manual data entry happens in minutes.

What This Means for Your Agency

Deposit protection compliance isn't glamorous, but getting it wrong is expensive. A single missed protection can cost thousands in penalties, plus the management time to deal with disputes and complaints.

With LetAdmin's deposit tracking, you get:

Immediate visibility - Problems are visible the moment you look at your tenancy list, not hidden in reports you might forget to run.

Contextual intelligence - Zero deposits and company lets are handled correctly, so you're not chasing false positives.

Everything in one place - Deposit amounts, scheme details, registration numbers, and certificates are all attached to the tenancy record.

Audit-ready records - If you ever face a dispute or a compliance check, all the evidence is organised and accessible.

For agencies managing 100+ tenancies, this could prevent at least one or two deposit protection mistakes per year. At potential penalties of up to four times the deposit per mistake, the maths is straightforward.

Run Your Agency from Anywhere

Check deposit protection status while you're at a property. Upload a certificate straight from your camera. Answer a landlord's question about their deposit scheme while you're between viewings. The mobile experience isn't a cut-down version of the desktop - it's the same powerful system, optimised for touch.

This matters for deposit compliance because problems don't wait until you're at your desk. When a tenant calls about their deposit certificate at 6pm, you can pull it up instantly and email it to them. When you're doing a checkout inspection and need to confirm the deposit details, the information is right there.

Coming Soon: Deadline Reminders

We're currently working on proactive reminders for deposit protection deadlines. When a new tenancy starts, you'll get a notification if the deposit hasn't been protected within 30 days. For tenancies approaching renewal, you'll get a prompt to review the deposit status.

The goal is to shift from reactive (spotting problems after they happen) to proactive (preventing problems before they occur).

How do you currently track deposit protection across your portfolio? Are there specific challenges we should know about? We're always looking to learn from agents' real-world experiences - drop us a message and let us know what would make compliance easier for your agency.